[ad_1]

For decades, NRG (short for the efficiently named National Research Group) has been a go-to source for folks in the movie business thanks to its tracking reports measuring audience interest in upcoming theatrical releases. (Wanna know how hard the next DC movie is going to bomb? They’re the early-warning system.) But more recently, the company — which until 2015 was owned by Nielsen — has been keeping tabs on the streaming world, looking at how thousands of first-run streaming shows and movies perform across various platforms and distilling that data, culled from thousands of interviews with consumers, into something called the Originals IQ Tracker.

This NRG report isn’t usually published for general-audience consumption, though the company does publish lots of public-facing data. But in honor of the tracker’s 200th week of analysis, NRG has identified some key trends from its four years of data and given Vulture an exclusive look. Among its findings:

➽ Streaming is how audiences today want to watch movies. NRG says 65 percent of Americans would rather watch a movie at home than see it in a theater. As recently as 2018, theatrical consumption was the default, with 57 percent of Americans choosing cinemas first. No surprise, the sea change happened in 2020, when at-home viewing took the lead.

➽ Marketing works, as does a good user interface. NRG says the average consumer needs to hear about or see information about a new title, on average, at least four times before they actually decide to watch it.

➽ Churn is real. Per NRG, one in five subscribers to the top streaming platforms have either just started or stopped their current subscription.

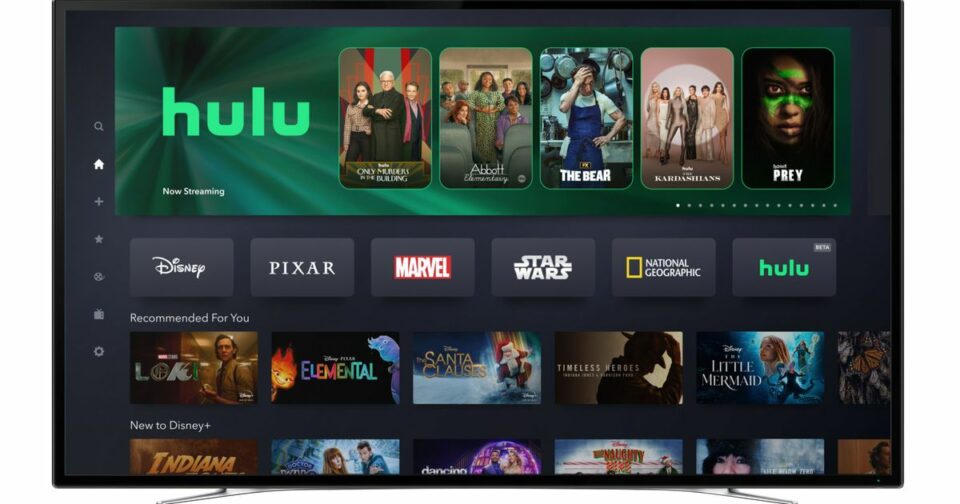

➽ Streamers have personalities. NRG asked consumers about the strengths and weaknesses of various services and took note of how they most often describe them. It says Netflix users rate the service highly for “the quality and range of their original programming”, while both Disney+ and Max are given high marks of their “rich film libraries.” Peacock, meanwhile, stands out for having live content (a.k.a. sports).

➽ To know them is to love them. NRG compared individual platforms’ subscriber numbers to weekly levels of brand awareness and concluded that overall viewing or general “brand love” were actually not the most important factors in goosing overall subscription gains. Instead, the company argues platforms need to be either “the top destination consumers go to browse for titles when they sit down in front of their TV” or simply top of-mind without being prompted. “These two more implicit behaviors are better predictors of how successful a streamer will be in growing and retaining its audience over time,” NRG argues.

There is one thing this NRG study didn’t address, however: How loudly consumers yell when they get wind of yet another streaming price hike. Maybe next time.

Related

- Who’s Winning the Streaming Wars Now?

[ad_2]

Josef Adalian , 2024-04-29 20:48:22

Source link